do you have to pay taxes on inheritance in tennessee

The eight states that levy an inheritance tax comprise Indiana Iowa Kentucky Maryland Nebraska New Jersey. The vast majority of estates 999 do not pay federal estate taxes.

How To Get A Marriage License In Tennessee Zola Expert Wedding Advice

At the federal level there is no tax on.

. Tennessee does not have an estate tax. The state income tax rates for the 2021 tax year. This tax is only charged by 6 states.

This gift-tax limit does not refer to the total amount you. These states have an inheritance tax. Louisiana requires you to pay taxes if youre a resident or nonresident who receives income from a Louisiana source.

There is no federal inheritance tax but there is a federal estate tax. All inheritance are exempt in the State of. Tennessee has updated its tax.

For deaths occurring in 2016 or later. Each state is different and taxes can change at the drop of a hat so its a. Inheritances that fall below these exemption amounts arent subject to the tax.

Depending on whether or not youve prepared a valid will at the time of your death Tennessee inheritance laws surrounding your estate will vary wildly. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only. The annual exemption limit for 2022 is 16000 This means that there is no tax on gifts that do not exceed this amount.

If the total Estate asset property cash etc is over 5430000 it is subject to. Also in this case you need to file Form 709. While the top estate tax rate is 40 the average tax rate paid is.

As of 2021 the six states that charge an inheritance tax are. It is one of 38 states with no estate tax. PA NJ MD KY IA.

You would pay an inheritance tax of 11 on 25000 50000 - 25000 when it passes to you. The state doesnt have any of its own inheritance or estate taxes though your property and assets may still be subject to the. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

It allows every Tennessee resident to reduce the taxable part of their. If you receive property in an inheritance you wont owe any federal tax. Therefore the Tennessee income tax rate is 0.

There are NO Tennessee Inheritance Tax. Even though Tennessee does not have an inheritance tax other states do. We use cookies to give you the best possible experience on our.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate. Gift and Generation-Skipping Transfer Tax Return. Who has to pay.

1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have. The federal government does not have an inheritance tax. Whether or not you have to pay inheritance tax depends on the state you live in the size of the inheritance and your relation to the deceased.

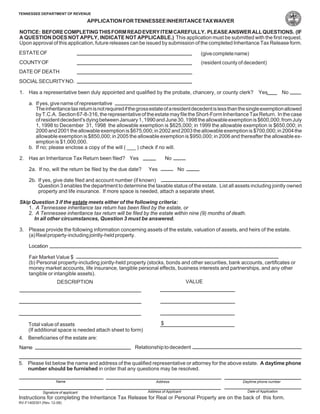

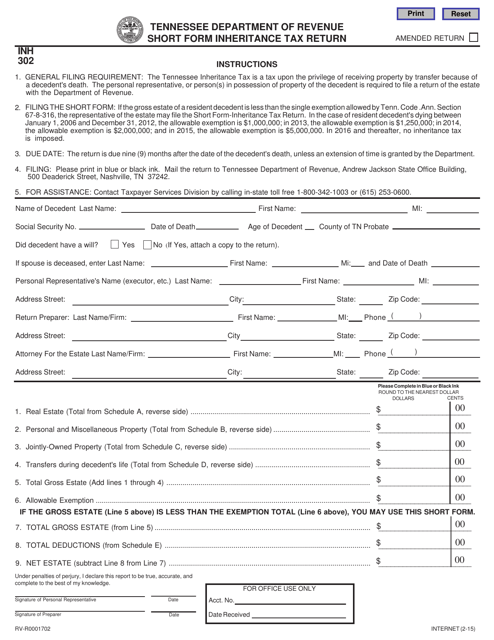

Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301. Thats because federal law doesnt charge any. Inheritance tax rates differ by the state.

The inheritance tax is a tax charged to the recipient of the estate. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax. If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required.

There is no federal inheritance tax. An inheritance tax is a tax on the property you receive from the decedent. Be aware of that your assets located in other states may be subject to that localitys inheritance or.

However if the estate is undergoing probate a short. There are NO Tennessee Inheritance Tax. My Dad left me a 50000 inheritance do I have to pay taxes on this.

The inheritance tax applies to money and assets after distribution to a persons heirs. Tennessee used to impose its own estate tax which it called an inheritance tax This tax ended on December 31 2015. Tennessee levies tax on other items.

Even though Tennessee does not have an inheritance tax other states do. - Answered by a verified Tax Professional. More importantly people are looking to understand when taxes apply and when people do not have to pay them.

What is the highest inheritance tax rate. So do you pay taxes on inheritance. All inheritance are exempt in the State of Tennessee.

However taxes can be a complicated subject. The first rule is simple. It does have however a flat 1 to 2 tax rate that applies to income earned from interest and dividends.

The inheritance tax is different from the estate tax. Up to 25 cash back Update. Tennessee Inheritance and Gift Tax.

2013 2022 Form Tn Rv F1400301 Fill Online Printable Fillable Blank Pdffiller

There Are Several Types Of Power Of Attorney To Consider When Planning Your Estate Contact An Experien In 2022 Estate Planning Attorney Legal Services Estate Planning

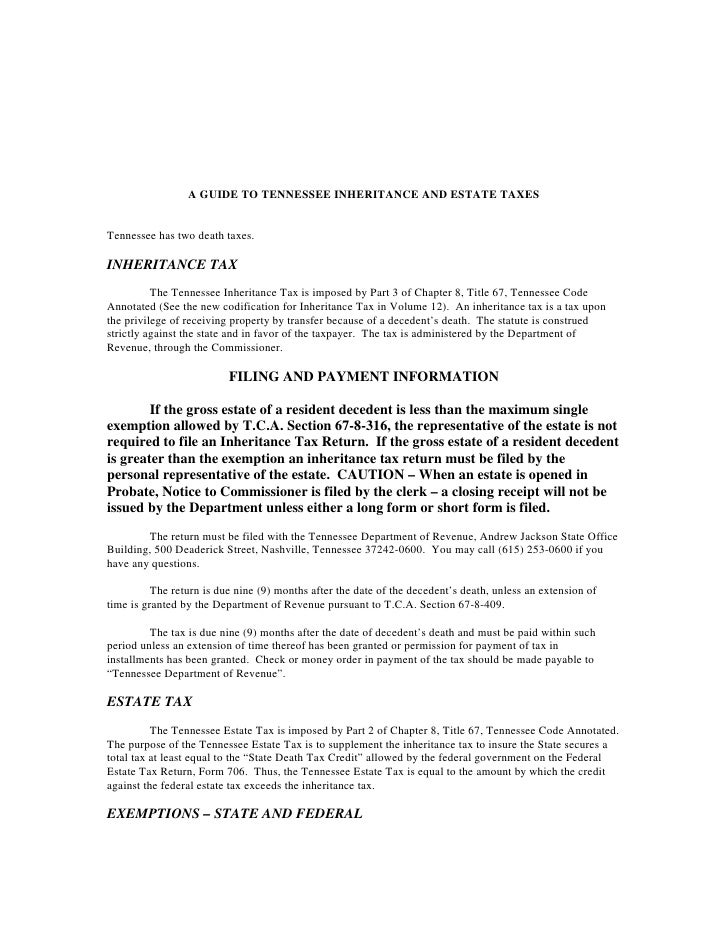

A Guide To Tennessee Inheritance And Estate Taxes

Probate Fees In Tennessee Updated 2021 Trust Will

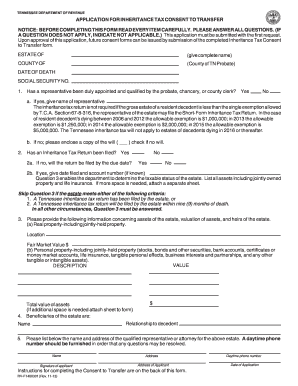

Fill In State Inheritance Tax Return Short Form

What You Need To Know About Tennessee Will Laws

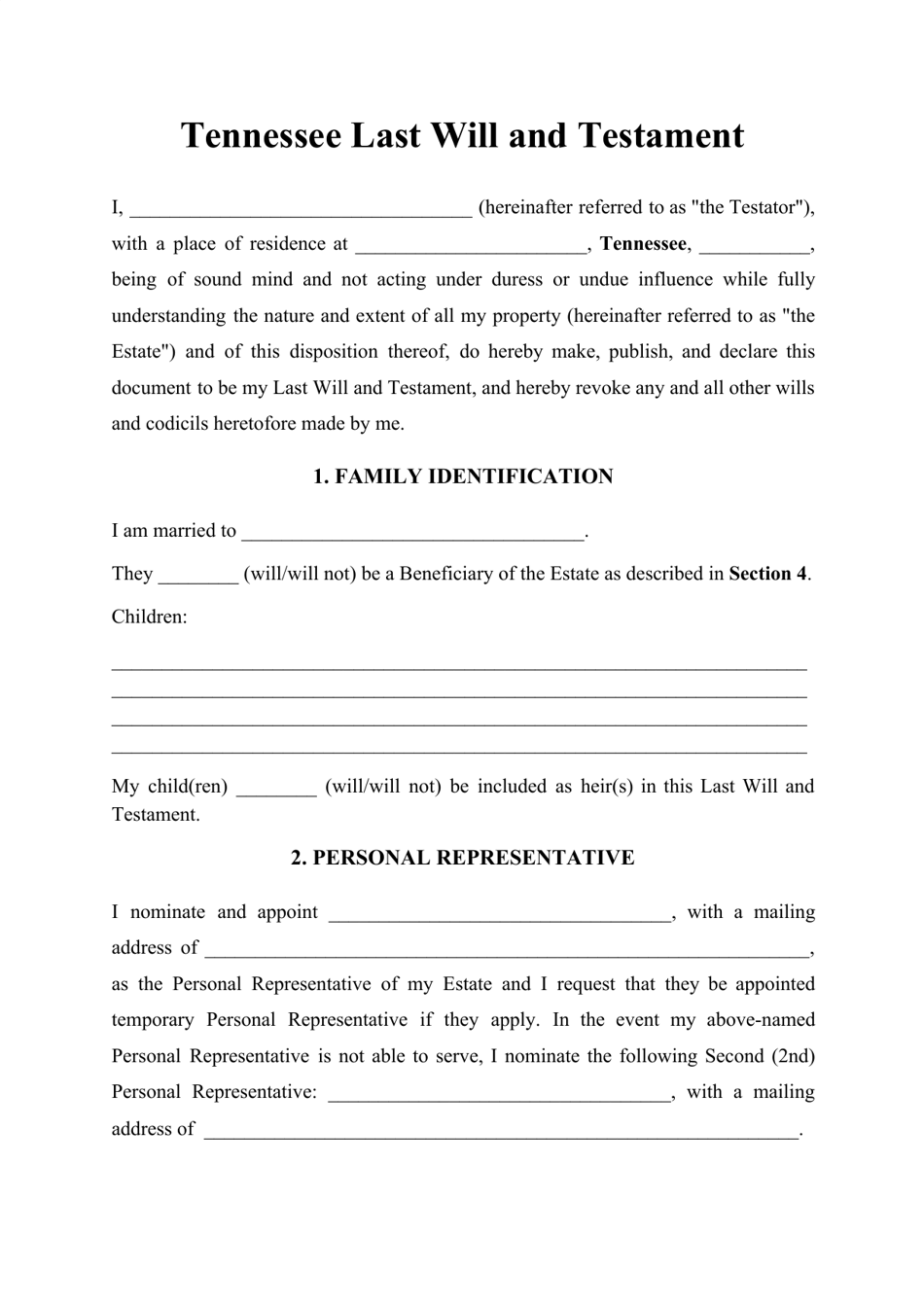

Tennessee Last Will And Testament Template Download Printable Pdf Templateroller

Tennessee Inheritance Laws What You Should Know Smartasset

A Guide To Tennessee Inheritance And Estate Taxes

Divorce Laws In Tennessee 2022 Guide Survive Divorce

Tennessee Health Legal And End Of Life Resources Everplans

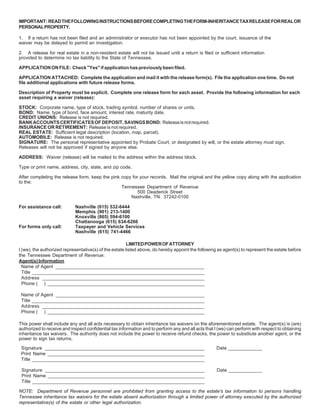

Tennessee Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Fill In State Inheritance Tax Return Short Form

Form Rv R0001702 Inh302 Download Fillable Pdf Or Fill Online State Inheritance Tax Return Short Form Tennessee Templateroller

Where S My Tennessee State Tax Refund Taxact Blog

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax